Client:

Stephens Landscaping specializes in the design, permitting, construction, and maintenance of exceptional residential and commercial landscapes with a team of over 75 employees.

Issues:

- Having hit the $14 million mark in revenue and 125% in year-over-year growth, the founder wanted help with budgeting, forecasting, and financial modeling.

- Recently consolidated their CRM and job costing software, which was a larger undertaking than anticipated, and the founder wanted expert eyes on the new system.

“I had sought out other firms, but they were all very salesy. AVL felt more a natural fit. No pressure at all. All their CFOs are true, tenured executives with the qualifications and experience to match. I wanted someone by my side working on budgeting and modeling without the $200,000 to $300,000 salary burden.”

–Mark Stephens, Founder, Stephens Landscaping

How We Helped:

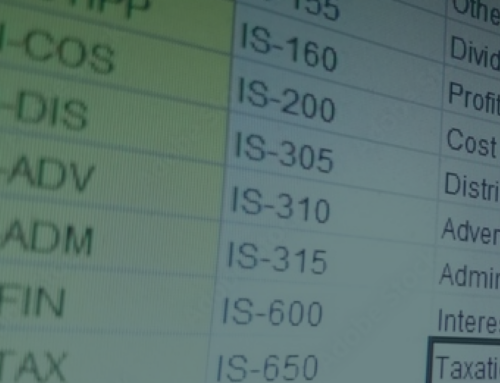

- A deep dive into the company financials led to closed gaps, a solid budget, and a reliable forecasting model.

- Fractional CFO J.P. Trembly from AVL worked with the client to create the financial model with near-precise accuracy.

- Completed a human resources audit and developed a one-to five-year plan for operational expansion that scales with financial growth.

- Benchmarked at the one-, two-, three-, four-, and five-year marks on what issues will arise and how to proactively handle them.

- Completed compensation benchmarking, developed a more scalable HRIS system, and started team coaching to elevate the internal HR team.

“Our team hasn’t built a company from startup to 500 employees, so we wanted the right experts on our side who could confidently support us in facing the challenges that will come up at various growth milestones. Now, with one number change in the model around staff changes, overhead changes, and equipment additions, we can see exactly how to adjust all areas of the company as we grow. It’s an extremely scalable model we can use for many years to come the future.”

Results:

“We have a lot better insight into our financials and models. We can add things to our forecast and make more educated decisions. We are extremely financially strong now. We manage our cashflow a lot easier. With finances and operations at peak performance, I can focus on other areas of the business like growth, people and quality.”

Get to peak performance.